SPANDANA could be next in IPO trail from Indian Microfinance sector

- Sunday, August 1, 2010, 18:54

- Featured News

- 1 comment

Microfinance Focus, Aug 1, 2010: Seeing spectacular performance of SKS Microfinance IPO, other big players in the sector are also gearing up to explore the gains of capital market. Hyderabad based Spandana Sphoorty Financial Ltd, which is ranked 6th in the world and 2nd in India in terms of outreach by Microfinance Information Exchange (MIX), could be next in IPO trail as their Board is actively evaluating the option for going public.

In response to a question of whether SPANDANA is planning to go public, Ms Padmaja Reddy, Founder and Managing Director of SPANDANA told to Microfinance Focus, “We are evaluating this at the board level”.

“Success of SKS Microfinance IPO signifies the belief of investors on poor women. It is a full proof to say that poor women are the best borrowers. The most important finding in the last two decades in the world of finance is Microfinance”, she added.

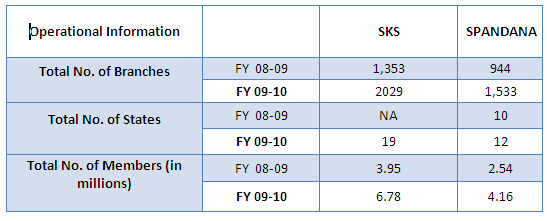

Established in 1998, SPANDANA has been enhancing its client outreach by around 100 annually since inception. As on 30th June 2010, it is serving 4.54 million clients through 1, 655 branches. It has disbursed a total of Rs. 13,763 cr. and enjoys a repayment rate of 99.9%.

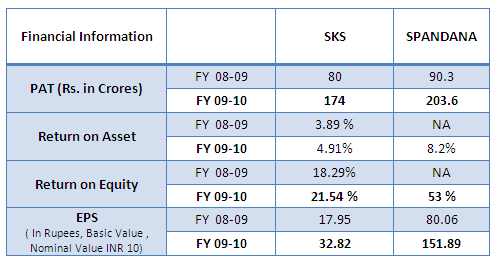

The organization which aims to be in the global Top 2 Micro Finance Organizations by 2012 has already emerged as a leader in profitability. Its Return on Equity (RoE) stood at an impressive 53% as against industry average of 23% (Intellcap-20). Its Return on Assets (RoE) is also double the industry average: 8.2% against the figure of 4% for the sector.

A comparative Performance between SKS and SPANDANA

A comparative analysis of SKS and SPANDANA performance based on their financial results for financial year 2010 reveals that SPANDANA is soon to outperform SKS and has already done so in many quarters. Going by its rapid scaling and strong performance, SPANDANA is sure to attract buyers if it floats an IPO in the coming future.

© 2010, Microfinance News. All rights reserved. 2008-09

One Comment on “SPANDANA could be next in IPO trail from Indian Microfinance sector”

Write a Comment

Gravatars are small images that can show your personality. You can get your gravatar for free today!

It would be interesting to let the readers know how a smaller organization like SPANDANA gets higher returns? Is the average loan size higher or are interest rates charged to borrowers higher? Is there some other explanation such as lower cost funding?