Special Report: Is the crisis over? The outlook for microfinance investment 2010

- Thursday, April 1, 2010, 16:25

- Featured News

- 1 comment

By Matthew Fuchs,

Microfinance Focus, April 1, 2010 : After a challenging year, 2010 has began on an optimistic note for microfinance investors. Some fund managers have declared that the recovery has begun, albeit a gradual one. For example, Dr. Armand Vardanyan, Fund Manager of the Dual Return Vision Microfinance Fund, has stated that MFIs are recovering, despite some isolated incidents, with an improving outlook for growth and profitability.

Echoing this sentiment, Alesha Wagle, Senior Portfolio Analyst, MicroCredit Enterprises, expects the overall investment climate for microfinance to improve in 2010. Christian Speckhardt, CIO at responsAbility AG also agrees, expecting MFI demand for credit to increase by 10-15% by year-end.

Certainly, the news so far has been good with major funds reporting positive results for January and February, ending a trend of negative returns in Q4 2009. These funds performed well in 2009, but the impact of the challenging economic conditions was clear with returns down significantly compared to previous years. For example the SMX 50, an index conducted by Symbiotics tracking the performance of major Luxembourg-registered funds, shows returns for FY-2009 at 3.08%, down from 5.95% in 2008 and 6.33% in 2007. This was in-line with the CGAP 2009 MIV Survey estimates which forecast returns to fall below 3.5% in 2009. Reasons identified by the survey for reduced returns included high proportions of liquid assets in fund portfolios, increased provisions against loan-losses and higher costs for currency hedging due to volatility in Forex markets. Any discussion of the outlook for microfinance needs to consider these factors, how they impacted investment performance in 2009, and what implications these have for the investment outlook this year.

Will investment conditions improve in 2010? Examining the underlying fundamentals

Liquidity

Liquid assets refer to the proportion of fund that is not invested, that is the difference between total assets and the microfinance portfolio. Usually taking the form of cash (although other non-microfinance assets may be included), a liquidity buffer is desirable to guard against cash-flow shortages. But as unproductive capital in the sense it is not invested in loans to MFIs or equity, if liquidity positions become to large they can place a drag on returns. For example, if a fund has 30% in liquid assets compared to 10% a year ago, 20% less of the fund is being put to use, even if the microfinance portfolio is the same size or even larger then it was. This situation can result when fund growth, for example through new contributions, out-paces the rate of investment. This is the situation which many microfinance funds are currently dealing with.

Increased demand for funds will help ease excess liquidity, which by the end of 2008 was around 20% for Luxembourg-domiciled MIVs according to the CGAP 2009 MIV Survey. For example, liquid assets such as cash increased significantly as a percentage of total fund volume from 2008 to 2009 for two major Luxembourg funds — responsAbility Global Microfinance Fund (rAGMF) and Dexia Microcredit Fund (DMCF).

Table 1: Cash and Liquidity positions as % of Total Assets

| Year | DMCF | rAGMF |

| 2010 (Jan.) | 27% | 28% |

| 2009 (Jan.) | 14% | 18% |

| 2008 (Sept.) | 11% | 10% |

Source: Monthly fund reports.

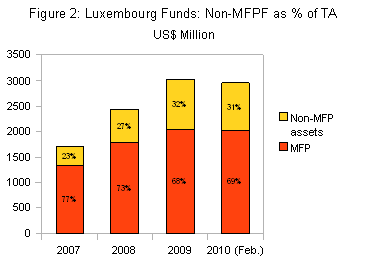

A similar trend can be seen in the percentage of non-microfinance portfolio funds (MFPF) of Luxembourg funds as tracked by Symbiotics, which suggests a high level of liquidity. While total assets of the SMX 50 index leveled off in H2-2009, there has been no indication that investor interest in microfinance has declined as fund managers remain upbeat in their expectations for fundraising in 2010. The CGAP MIV Benchmark Survey estimated that total assets would grow 26% in 2009, which would bring total MIV assets to $8.5 billion. If total assets were to grow at a similar rate in 2010, liquid assets could actually increase and put further pressure on fund returns.

Portfolio quality and loan-loss provisioning

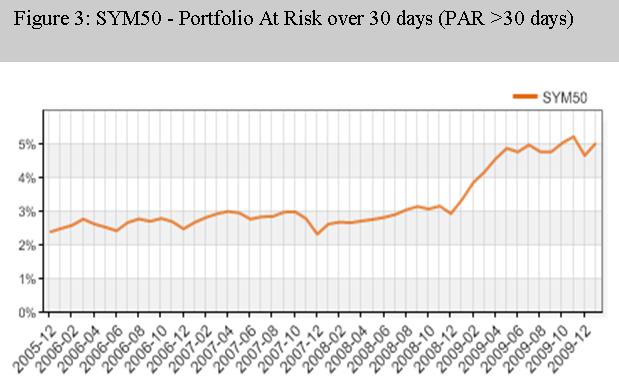

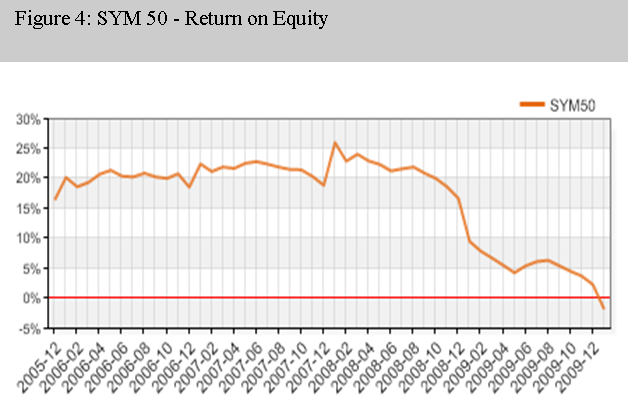

Loan-loss provisioning is the expense that has to be set aside to cover losses from bad loans, whether through defaults or renegotiation of terms, such as extension of repayment period or interest rate concessions. Initially, financial performance remained strong throughout most of 2008, maintaining confidence that MFIs were well position to weather the downturn. According to the SYM 50 — an index by Symbiotics tracking the performance of 50 large MFIs — Portfolio at Risk (PAR) spiked dramatically in December 2008 and peaking at over 5% in October 2009. This in turn directly affected financial performance, with Return on Equity (ROE) falling steeply at the same time.

In response, MFIs generally slowed the growth of their loan portfolios to concentrate on maintaining portfolio quality. However, weakening portfolios has forced some fund managers to take provisions against troubled loans in H2-2009, as revealed by publicly available monthly fund reports. Except for two cases, it was specified that these provisions were made for loans to troubled MFIs in Nicaragua and in Bosnia and Herzegovina. These countries have been affected by repayment crises which have undermined the phenomenal growth that was key to making these countries investment hotspots . A recently released report from CGAP, ”Growth Vulnerabilities in Microfinance”, examines these and two other repayment crises in Morocco and Pakistan.

The report reaches an important conclusion — that while the economic downturn was a “contextual factor”, the repayment crises resulted primarily from underlying issues stemming from rapid growth and aggravated, in some instances, by local anti-microfinance factions such as the ”No Pago” movement in north Nicaragua. According to the report, during this period of rapid growth four key vulnerabilities emerged: concentration of lending within specific areas, multiple borrowing resulting in high levels of client over-indebtedness, overstretched MFI capacity and loss of lending discipline. These crises are ongoing and will continue to be problematic in 2010. Therefore further loan loss provisioning remains a possibility.

Addressing the issues that caused the repayment crisis will take concerted action at a local, regional and national level. Suggestions the CGAP report makes include overhauling MFIs operations to refocus attention on portfolio quality through improving portfolio quality monitoring, client satisfaction assessment and developing credit bureaus and strengthening existing ones. Rebuilding the sector and restoring confidence will take time, possibly years, ruling out a quick recovery. As the report points out the experience of Bolivia, which was affected by a repayment crisis in 1999, demonstrates that such events can lead to development of a stronger and more sustainable microfinance sector in the longer term.

However, microfinance has changed significantly since then. For example investors, rather then donors, are primary funders of the sector. As a young investment sector, these repayment crises are the first to truly test the current microfinance investment model. Despite a drop in performance, the sector has handled the challenging conditions well, with no funds reporting any serious financial problems due to the repayment crises. Regardless, it will probably prompt a review of risk management strategies and encourage further portfolio diversification. Hopefully, this experience will also enable investors to detect signs of stress earlier so that action can be taken to help prevent future repayment crises from developing.

Equity investments – boom or bubble?

Equity investments in the sector are increasing in importance for the sector, with equity as a proportion of all MIV assets growing by 47% from $987 million in 2007 to $1.45 billion in 2008, representing 24% of MIV investments according to the CGAP MIV Survey. Part of this growth is due to the increase in specialist microfinance private equity funds, with 13 such funds in 2008 representing $257 million. And this figure does not include equity investments made by Development Finance Institutions (DFIs), such as the IFC and EBRD, specialist vehicles established by pension funds, or mainstream venture capital and private equity firms.

An interesting finding of the report was that despite an unprecedented drop in asset quality, and a simultaneous decrease in profitability, MFI equity valuations continued to rise. It concludes that net income growth, rather then profitability, are the key drivers of valuations as investors seek MFIs with high growth prospects. While this trend occurred across all regions the highest multiples were in Asia, with price-to-book value multiples of 5x, well above the global median of 2.1x.

Table 2: Microfinance Private Equity Transactions:

Price-to-Book-Value

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Africa | 0.9 | 1.2 | 1.6 | 1.8 | NA |

| Asia | 1.7 | 2 | 5.1 | 2.9 | 5 |

| ECA | 1.8 | 1.3 | 1 | 2.1 | 2.2 |

| LAC | 1.4 | 1.2 | 1.1 | 1.2 | 1.3 |

NA indicates fewer then five deals

Source: CGAP Microfinance Global Evaluation Survey 2010.

The main contributor to these high figures have been the rapidly expanding Indian market, where valuations have reached 5.9x price-to-book value, nearly three times the global median. This in turn reflects the large influx of capital into the microfinance sector there, which VCCEdge estimates to be around $80 million, representing 40% of all private equity deals in India. According to the CGAP report these multiples are difficult to justify and are a cause for concern, arguing that valuations are being inflated by high capital flows from investors motivated by short-term gains. The report even draws parallels with the dot.com bubble, alluding that an equity bubble may be also developing in the Indian MFI equity market.

This influx of capital will probably increase this year in anticipation of the much vaunted IPO from India’s largest MFI, SKS Microfinance. This may be not only from investors seeking to profit from not just the SKS listing but also the subsequent IPOs that are expected to follow, which is likely drive up valuations further and reinforce a bubble mentality. At the same time it may encourage investors to look further afield to less competitive microfinance markets in northern India where markets are less penetrated and valuations may be lower. Certainly, this will be a situation that will need close monitoring, as 2010 looks set to be both a landmark year and critical turning point for the microfinance equity market in India.

Regional Outlook: An uneven recovery in 2010?

BlueOrchard’s observation on the current state of the microfinance sector echoes that of the economic outlook. In the DMCF’s January report, the fund manager stated that although most regions were coming out of recession, some regions remain under significant pressure — especially Eastern Europe and Central America. Christian Speckhardt from responsAbility supports this view also, stating that although there is a noticeable improvement in credit quality overall, risk metrics in Eastern Europe and Central America are likely to continue rising slightly.

According to Mr. Speckhardt loans in local currencies will become more common in 2010, which will open up more opportunities in Sub-Saharan Africa. Armand Vardanyan, Fund Manager of the Vision Microfinance Dual Return Fund, also foresees increased opportunities in Africa and Asia throughout the year.

Asia and Sub-Saharan Africa, despite having several fast growing microfinance markets will still occupy a small share of fund portfolios compared to Eastern Europe and Central Asia (ECA) and Latin American and the Caribbean (LAC). South Asia’s share has been growing consistently since 2006, and is expected to have had a record year of growth due in large part to the rapidly expanding Indian market. With a large unserved market, particularly in the north, India is expected to continue to be one of the fastest growing markets in 2010. However at present most investment is concentrated in MFIs based in the south, fueling concerns that this inflow of capital could encourage the development of a debt bubble in the southern states. Based upon analysis of lending levels in Andra Pradesh and Karnataka, a recent article argues that a bubble has already formed (see Daniel Rozas’ Is there a Microfinance Bubble in South India?). According to the article, this leaves the entire sector in India vulnerable to a spark which could ignite a repayments crisis, such as a sudden drop in economic growth or a populist movement.

Coupled with the possibility that an equity bubble is also forming, such a crisis would be a double blow not only to the Indian microfinance sector but could also undermine the emerging MFI equity market. The isolated repayment crisis in the town of Kolar, near Bangalore, demonstrated that the risk is real. Lessons from the current repayment crises in Nicaragua and elsewhere suggests that concerted action should be taken to guard against a similar crisis in India, starting with addressing client over-indebtedness resulting from multiple borrowing. Despite this risk, which will require close monitoring over the next 2 to 3 years, 2010 is likely to be another standout year for Indian microfinance investment. This inflow is likely to have reduce the gap between South Asia and East Asia/Pacific (EAP) as a share of total portfolio allocation in 2009.

Regardless, EAP will continue to be an important region for investment in Asia, with the region boosting two large, well established microfinance sectors — the Philippines and Indonesia. However, the main draw for investors has been the much smaller but booming market in Cambodia. According to the IFC, lending from MFIs has increased 55% annually between 2006-2008, with total outstanding loans of US$440 million YE-2008. In 2009 the sector continued to grow, with data from the Cambodian Microfinance Association showing that outstanding loans of member MFIs grew by 13% between Q4 2008/09, from US$437 million to US$493 million.

Sub-Saharan Africa (SSA) has not enjoyed the same inflow that Asia is attracting, growing steadily but maintaining a portfolio share of between 6-7% of the total MIV asset pool according to CGAP 2009 MIV Survey figures. But as a share of major globally active Luxembourg funds, it is often much smaller, between 1-3% according to available fund reports. This reflects in part the continuing dominance of donors in the region who provide 74% of funding to microfinance in SSA — the largest share of any region according to the CGAP 2009 Funder Survey. As noted by the Microscope 2009 report, commissioned by the IDB, CAF and IFC, the investment climate in the region has been limited by comparatively high political and economic risk as well as weak financial sectors. Another important factor has been the shortage of commercially orientated, investment-worthy MFIs, as is reflected in the region’s comparatively low ROE (Table 3).

Table 3: Return on Equity (ROE) by Region

| Year | Global | SSA | EAP | ECA | LAC | MENA | SA |

| 2008 | 5.68% | -0.73% | 12.57% | 3.17% | 7.63% | 4.56% | 2.99% |

Source: MIX Market (adjusted data).

However the influence of donors has had a major benefit for African microfinance. The implementation of progressive regulatory regimes in SSA has been largely due to the political influence of donors and DFIs, the Microscope report argues, with the region poling first in the regulation and supervision rankings. This has in turn fostered the growth of regulated NBFIs, many of whom are able to collect deposits. As a result the region has become a pioneer in mobile banking with a range of initiatives launched in 2008, all of which bodes well for the future of microfinance investment in SSA. However, growth is likely to be more gradual compared to SA and EAP, which will be limited to an extent by the region’s smaller and less concentrated markets.

Despite greater stability over the last decade, political risk in SSA will continue to be a limiting factor. Guarantees have the potential to address this issue, as demonstrated by two recent investments. In one, Incofin invested in the equity of FINCA Congo with the aid of a guarantee from the Belgian government. In the second, Terrafina together with BRS, ADA and Cordaid, acted as guarantors to facilitate loans to four Ethiopian MFIs from local commercial banks. At any rate, it will be interesting to see if guarantees play a more prominent role regionally in 2010.

MENA, which weathered the recession well, has solid growth expectations in 2010. However, the region’s small and immature microfinance markets currently limits the scope for significant expansion in investment opportunities. Furthermore, Morocco, MENA’s most developed microfinance market, is still repairing the damage from the repayment crisis, so growth in that country may stagnate or even contract. Therefore, portfolio allocations to the region are likely to remain unchanged at around 1%.

2010 – a year of consolidation

Christian Speckhardt from responsAbility sums up the mood well when he described 2010 as a year of “transition and maturity” for microfinance. For the sector 2009 represented a turning point, with conditions testing the strength of the microfinance model. On the whole the sector has has done well, but it has also brought to the surface underlying issues the industry needs to address as it matures — adequate risk management and balancing of growth with operational sustainability. With growth expected to slow in 2010, this will give the sector a chance to consolidate the gains made in recent years by focusing on addressing these issues.

Likewise, microfinance investors will also need to adjust to this new climate. While MFI demand for debt is expected to recover in 2010, it is likely to remain lower then pre-crisis levels. This may mean that if fundraising remains strong funds may find it difficult to lower fund liquidity, which may in turn maintain pressure on fund returns.

Equity investments will continue to grow in importance during 2010, centered around the high growth market in India. While 2010 is likely to another standout year for equity investment in that country, with signs of a valuation bubble developing the situation will have to be monitored closely.

In 2010 investment in Asia and Sub-Sahara is likely to increase as investors seek to further increase fund diversification and take advantage of growing opportunities in these regions. Investment in the more established regions, Europe and Central Asia and Latin America and Caribbean, may grow more slowly and possibly decline as a percentage of microfinance portfolio allocations.

[1] Figure includes small loans issued by ACLEDA but not new members added during 2009, to eliminate the influence of new members on growth figures.

© 2010, Microfinance News. All rights reserved. 2008-09

One Comment on “Special Report: Is the crisis over? The outlook for microfinance investment 2010”

Write a Comment

Gravatars are small images that can show your personality. You can get your gravatar for free today!

2010, in my opinion is going to be of mixed outcomes.

I strongly feel that availability of funds, and through that liquidity, might not be a major issue. Microfinance, is also truly taking the banking “norm” of the “Haves’ getting more funds and the “Have nots” looking everywhere for funds. That way, well established organisations would get the lions share of funds through investments, debt, securitisation, buy outs and what not. In my humble opinion, consolidation would remain on the drawing boards, at least in the Indian context, as the number-chasing would continue unabatedly. Probably location / area consolidation by the few “top” MFIs may take place, but most probably the real consolidation may not take place till the so called “bubble effect” takes place. In this race for “locality / area consolidation” quite a good amount of multiple-disbursements would take place and thus creating “Credit polluting” circumstances. The Repayments, especially the On Time Repayments (OTR), would see, to a certain extent, adverse changes and thus the reapyment rates of 99% + can be seen in fewer and fewer cases. Naturally PAR also would be affected and as delinquency increases, profit levels decrease, cost of funds and also recovery cost would increase.

Yes, this year could be changing decisively, but it is 2011-12 when real and consolidating changes can be looked forward to.

Best wishes Hemantha Kumar Pamarthy (In Individual Capacity)